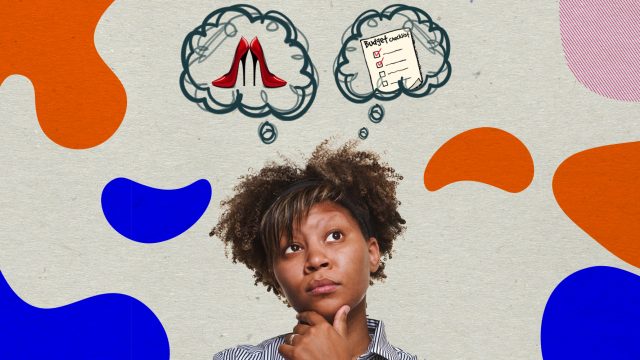

The importance of planning finances

How I learnt to live the life I want through financial planning and budgeting.

I don’t quite remember when I developed an interest in shoes. I’m not sure if as a child I ever tried on my mother’s shoes the way little girls all do or the interest came after high school and I had the time to discover my personality, likes and dislikes. Either way, fast forward to some years close to thirty and shoes are my all-time love.

When I was younger and living with my parents I’d shop for a lot of ‘mitumba’ shoes – what is called thrifting these days – from street vendors and be blown away by the variety. Of course being second hand they’d not last as long, but the good thing is they were affordable – and I’m talking 3 pairs of shoes from one thousand shillings, so I could shop every couple of months.

Then employment happened, parents cut off the financial support and I graduated to an adult. The most memorable thing about it was the independence that came with it. I had my own money to spend as I pleased. Amazing.

Employment also introduced me to fashion. For most jobs looking the part is half the job. This is especially true in the communication industry which many may not admit, is very image-conscious.

I learned early on I needed to dress the part to garner client and colleague respect alike. Therefore, immediately after paying for utilities, younger me would spend the remainder shopping for outfits that show why I deserve a seat on the table no matter what my business card said I did. All on impulse.

I personally assess an outfit from the shoes up – I believe shoes make or break an outfit. They are always my starting point when building an outfit so it’s no wonder they’re the most expensive item in my closet. I spend generously on my ‘babies’ as I like to call them. Notice the continuous tense.

Impulse Buying

This additional expense funded by my monthly income would leave me quite broke more often than not as it was all based on impulse. Especially the shoes. My gorgeous babies that I’d rationalize paying an arm for every single time. Things got so thick once I had to call my father to bail me out in the middle of the month thanks to my lack of planning.

That was the wakeup call. As a firstborn, financial independence is non-negotiable as it sets an example to my siblings. The call did not go badly at all; it’s the personal disappointment that accompanied it that got the best of me. Questions like ‘Was this really worth it?’ ‘What happens when you have other expenses?’ ran through my mind over and over.

After the bailout, I immediately took to planning my finances and introducing a budget to address my not-so-good money habits that I had developed. The planning enabled me to introduce a savings mechanism for rainy days and the budgeting limited my spending to only items that were planned.

The financial planning not only kept me from being broke, but it also instilled a sense of personal discipline that has guided me both professionally and personally.

It was not easy at the beginning. Friends are a strong influence in our spending as we develop our habits by association. I had to consciously remind myself of my budget every time an idea involving excessive spending came up and discipline myself enough to choose to miss out.

This went on so well that a few years later I managed to go on my very first personally funded vacation without a single glitch! Needless to say, it also introduced traveling as a new budget item.

Thanks to financial planning and budgeting, I have not had to comprise on my taste in shoes and fashion and it has also allowed me to take up new interests without having to break my back.

It was all worth it.