Chumz App on a mission to help Kenyans build a saving and investing culture

The mobile application helps people to build a saving and investing culture over time.

Early last year, Chumz, a Kenyan savings and investment app was launched into the mass market.

Chumz is one of the latest entrants into the savings and investment space where users can save as little as KSh5 on their mobile phones. Over time, the aim is to help people build a savings and investing culture especially since Kenyans have a low savings culture. On the platform, users can save towards the goals they choose, track their progress and earn interest.

The mobile application is the brainchild of Samuel Njuguna, one of the co-founders of the solution who is also the Chief Executive of Moneto Ventures, the mother company.

Rolling out the app wasn’t easy, says Samuel. Before the app ever saw the light of day or got its feet wet in the market, it underwent months of intensive research to find a suitable market and a target audience.

“We started doing research in late 2019 about why people don’t save. This is after observing that people do a lot of transactions on their mobile phones, but they do not save. We extended that research from our friends and peers to those outside our circle. Then in mid-2020, we started building the app. In 2021, we applied for the license from CMA,” he says.

The app was among eight innovative African startups that were selected to participate in the 2021 edition of the GreenHouse Lab accelerator programme where participants secured a $10,000 investment.

The Capital Markets Authority (CMA) then placed Chumz in their sandbox where they were allowed to operate for a period while monitoring how the technology worked. Chumz met all the requirements and in 2022, the app was released to the public.

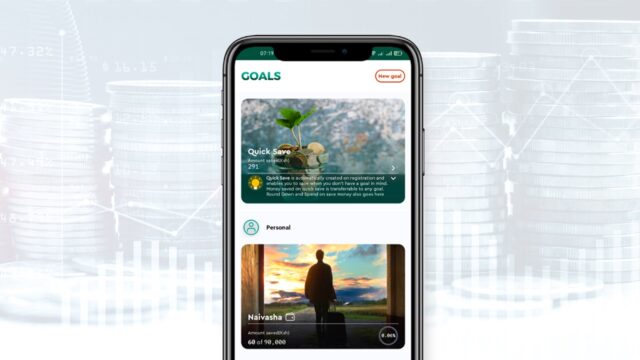

Creating a goal

Chumz, which is slang for money, currently has over 50,000 registered users. The app is available on Play Store and App store. Once logged in, a user can create a goal or a reason they want to save money e.g. for school fees or a vacation. Once you create a goal and start depositing money, you can easily track your progress which can be seen on the interface that also shows you how much you have saved against your target amount and the interest earned so far. Normal savings earn an interest of 6% annually while locked savings earn an interest of 8% annually. One can also create a reminder to nudge them to save. On the Quick Save feature, a user can save if they don’t have a specific goal or, if they prefer, transfer money into it by rounding down the amount of money they have on M-Pesa. And whether a user achieves their goal or not, they can withdraw their money at any time. However, it takes two days to get money withdrawn from a goal and the funds are deposited into one’s M-Pesa account.

The app also has a Groups feature that allows users to save with their friends for a common goal. People saving in Groups can chat in the same channel where they are saving their money. When a person(s) in the group saves, it alerts the rest of the members and this creates some pressure or pushes the others to also want to contribute (if they haven’t) to the goal.

“In our society, we know people save more when they save in a group. In behavioural finance, we call that a social nudge – the fact that you are doing it as a group gives you pressure from your peers to save,” says Samuel.

At its core, Chumz uses behavioural finance to help people save and invest their money. Behavioural finance is an economic theory that explains why people make certain financial decisions; simply put, Samuel says behavioural finance deals with how people form habits around finances.

Traditionally, he continues, the theory around economics has always been that people work to maximise their financial gain. But what research has shown is that people don’t always operate to maximize their gains, sometimes their emotions come into play. These emotions and behaviours are tied to people’s psychology or behaviour and are used to guide them to build certain habits or to achieve a certain goal.

One form of saving that is associated with behavioural finance is Default Bias. An example of Default Bias is when someone places a standing order with their bank to save KSh1,000 at the end of every month. This is a pre-set option for them which they “flow” with every month.

Samuel’s past work experience at a credit scoring company for the unbanked also greatly informed his research. To decide how much money a financial institution can lend to an individual, he says alternative data like M-PESA statements or data from payment companies is used to model credit scores.

“So, while doing that, it was very clear people weren’t saving and investing. What we did after that was, we asked, ‘why is this the case?’. And interestingly enough, what we found in our market is that most fund managers, if you want to invest, ask for a minimum of KSh1,000. But, over 50% of people in Kenya earn below $3 a day, which is essentially around KSh375,” he says.

Even though a lack of funds is a huge hindrance to saving and investing, Samuel is seeing a tremendous improvement in the app.

“Over 70% of users save below KSh1,000 on the app, they are however consistent in their saving. Remarkably, 65% of the savers are women,” he says.

Samuel feels they have achieved a lot and are succeeding in helping people in the country build a savings culture, even though they may be few compared to the population of the country.

“We are seeing people meet their goals and that’s part of our testimonials. It’s a very fulfilling journey seeing people say they have met their goals,” he says.

For its efforts in enhancing digital savings, the app won the award for Best Mobile App, Digital Savings at the 2022 Mobile App Awards. There are other saving and investing platforms in the market such as M-Shwari, Mali, Koa and Cashlet which are regulated under the CMA sandbox, albeit with varying interest rates.

Plans are underway to expand Chumz to Rwanda and Uganda.

“We are already doing some work to get into those two countries and the regulators there are warm to the idea of a tech-led savings and investment culture,” Samuel says.

There are, however, questions on how safe the app is from social media users and to address this, Samuel says there are steps they have taken to ensure people can trust the product. First, Chumz is licensed by the Capital Markets Authority, and second, all the funds collected are channelled to fund managers who are regulated and licensed by CMA.

“Third, all that money that is collected goes into a custodian bank account owned by the fund manager. A custodian bank account is a special bank account allocated by CBK and the likes of CMA, which ensures funds aggregated are public funds, and they can see what’s happening with the account, he says.

From the FAQs on the website, Chumz has invested in the Nabo Money Market KES Unit Trust, which is managed by Nabo Capital as its fund manager. The unit trust is audited by Grant Thornton and has KCB as the approved trustee and Stanbic Bank as custodian.

Currently, on the app, the focus is on the 52-Week Challenge, a popular saving plan that requires people to save incrementally throughout the year.